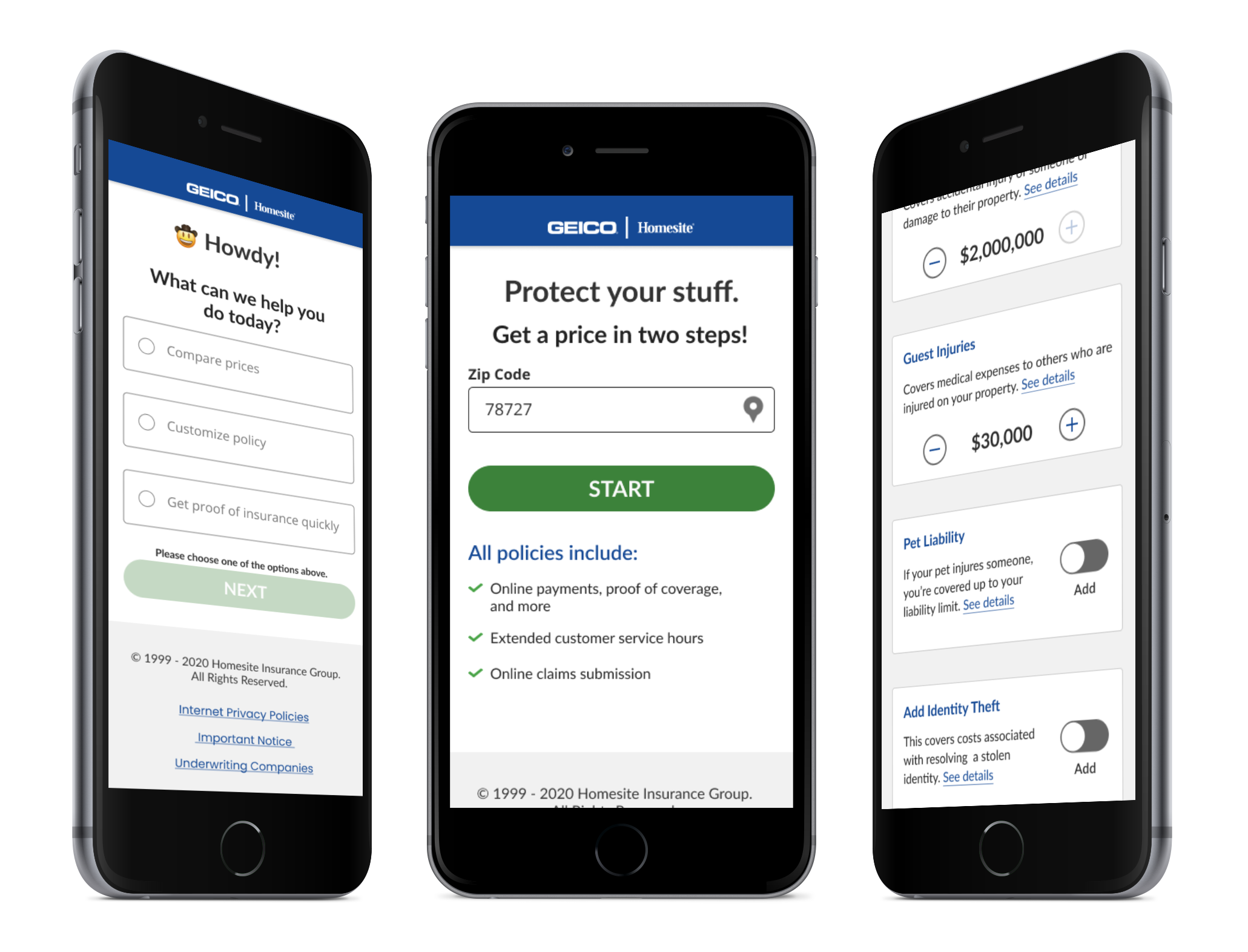

Geico Renters Insurance

Optimizing the buying experience for mobile users

Overview

The renters insurance yield was lower than competitors in the same markets. As UX Lead I first looked for usability issues and then began researching what renters wanted from their policy and from their online experience.

Analysis

After conducting surveys and user interviews, I found 90% of participants were mainly interested in protecting their personal assets with 75% of those rated getting coverage quickly as possible as a high priority. The majority of customers visited the current site on their mobile devices, ranged between 22 and 38 years old. Customers surveyed had an above average technical proficiency with online interactions. Conversion yield of visitors was 82% higher with those that made any edits to the suggested coverages. There was also an observed delight from users interacting with personalized prototypes during user tests.

Solutions

After helping to align our UI with Geico standards, I began ideating on simplifying the flow and adding some personalization to the experience to increase value and trust. Next was getting state specific personalized messaging and coverages. Analytics showed that users that adjusted their coverages on the site were 82% likely to convert to a policyholder. So inline customization was tested in both user tests and A/B production testing. It was a great success.

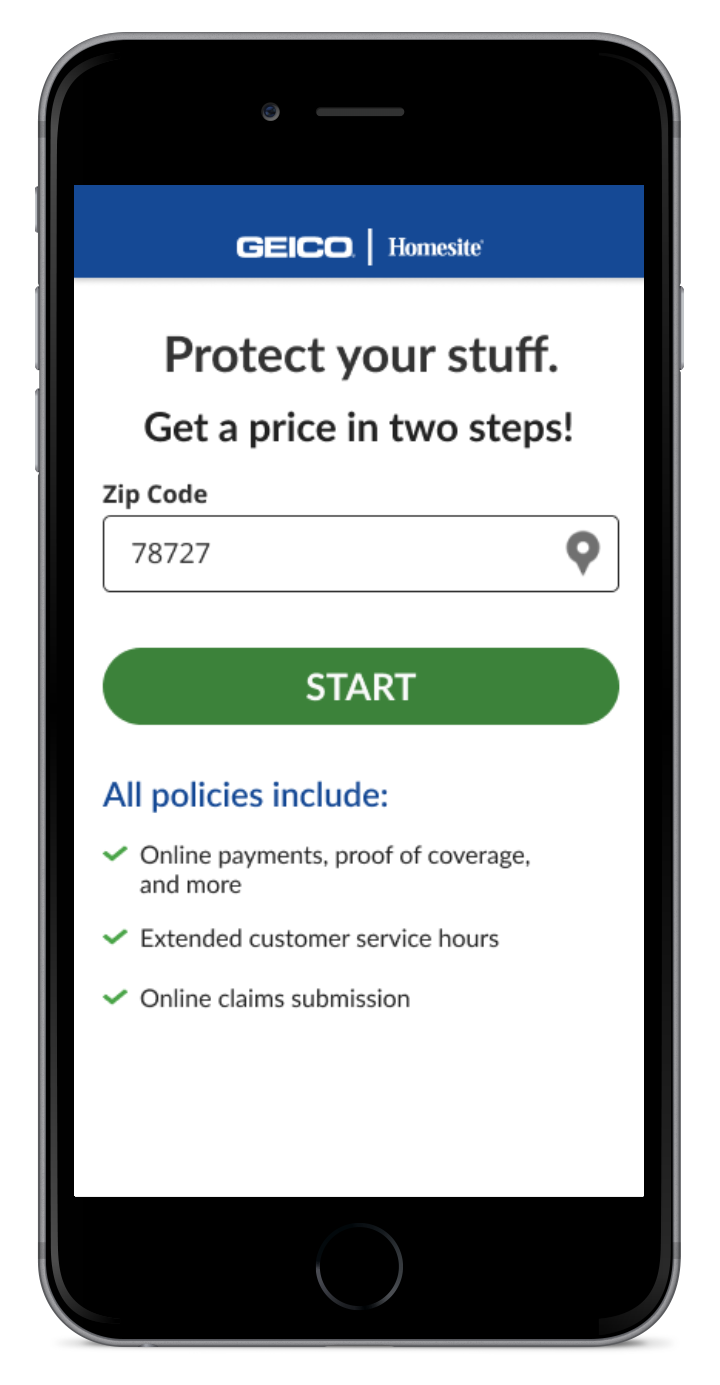

Zip Code First

We only needed the user’s zip code to provide a base quote for renters insurance. So with five digits, instead of an entire address, we could get the user started on their journey to purchasing a policy.

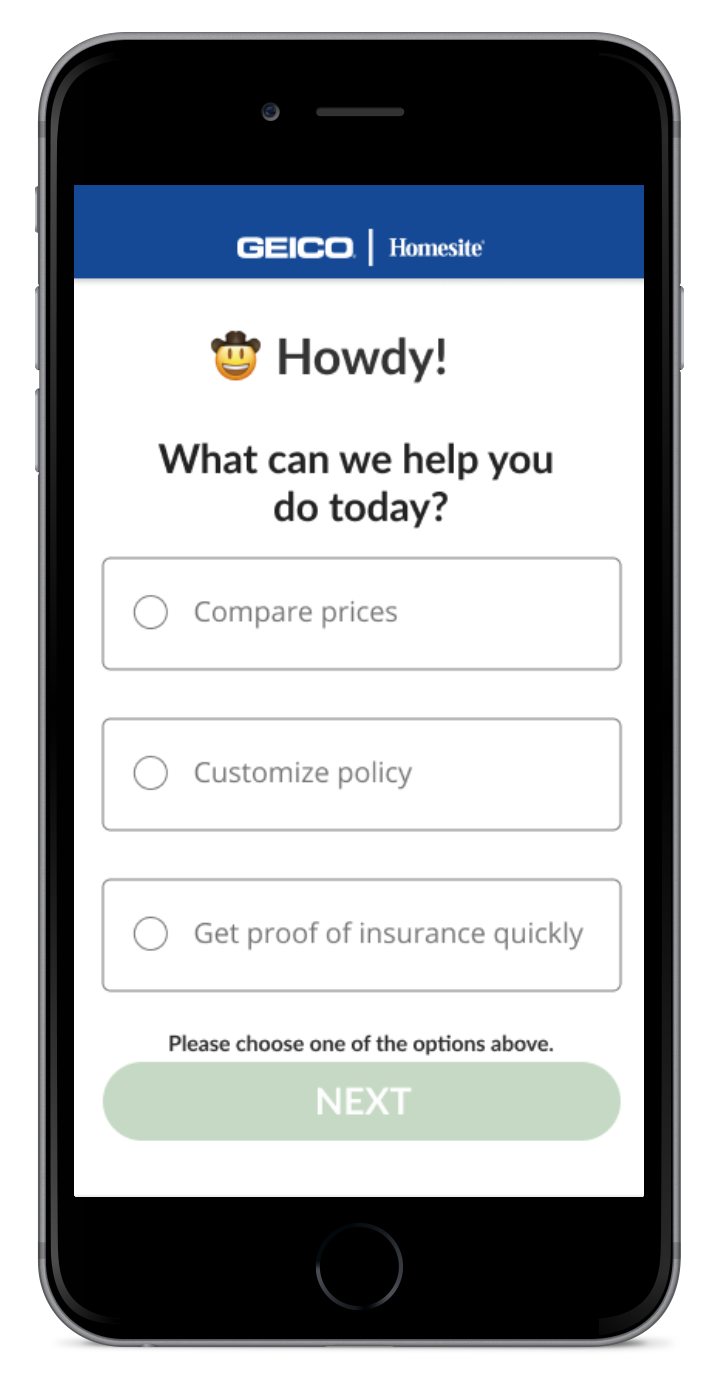

Howdy!

During user interviews and testing, participants mentioned they enjoyed seeing state or regional messaging. In addition to conversational voice and state or regional messaging, we also suggested coverages that our analysts felt would be of value for individuals in their particular state or region.

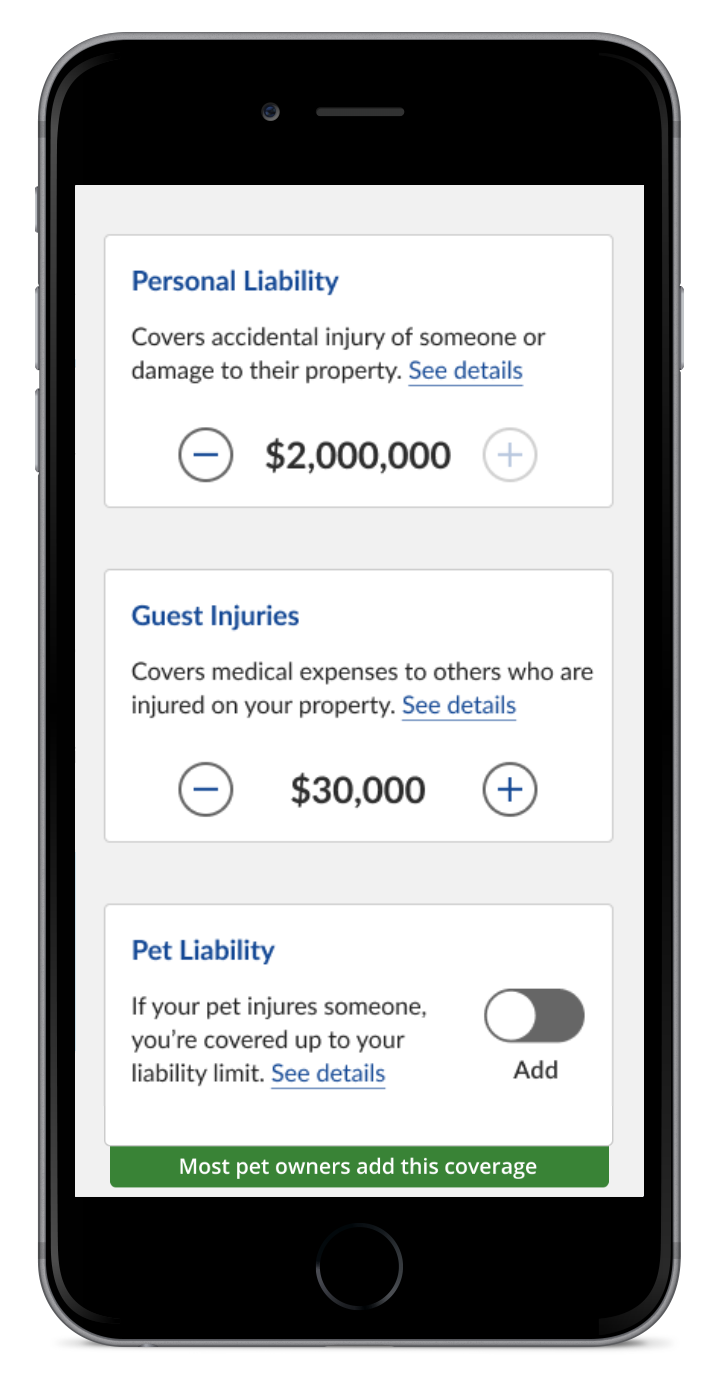

Coverage Customization

Inline customization showed to be a great delight for participants in validation testing and A/B production tests and gave users the ability to edit their coverages easily. A taxonomy study showed that many customers could understand each coverage type with shortened and customer friendly content. With the industry jargon eliminated and coverage customization, yield increased by 30% in the first month.